high iv stocks nse

Put Options Screener with High Implied Volatility - Indian Stocks. Stock passes all of the below filters in futures segment.

Latest Close Latest Volume Greater than Number 2000000000.

. Higher Implied Volatility Suggest traders are actively trading At this. NSE Options with High and Low Implied Volatility. Your Saved Screener will always start with the most current set of symbols found on the source page IV Rank and IV Percentile before applying your custom filters and displaying.

Higher Implied Volatility Suggest traders are actively trading At this. If the 52-week high is 30 and the 52-week low is 10 and the. For Canadian market an option needs to have volume of greater than 5 open interest greater than 25 and implied volatility greater than 60 the Lowest Implied Volatility.

Put Options Screener with High Implied Volatility - NSE. Short Build Up- Call Option. High Volume FnO Stocks.

View and Learn more about stock share market Most Active Securities Today visit NSE India. Stock passes all of the below filters in futures segment. Traders should compare high options volume to the stocks average daily volume for clues to its origin.

The trading symbol of the future contract is INDIAVIX. StocksShares Trading at 52 Week High in NSE. StocksShares Trading at 52 Week High in NSE.

Check trading volumes daily weekly or monthly to make informed decisions. Get a List of most active NSE shares with highest trading volumes in a particular day. Low Put Call Ratio.

27 rows Create a stock screen. View stocks with Elevated or Subdued implied volatility IV relative to historical levels. Short Covering - Call Option.

LIVE Alerts now available. Get a List of most active NSE shares with highest trading volumes in a particular day. Futures on its own volatility index India VIX.

FO - Listing of Stock With High Call Options Implied Volatility for Indian Stocks near month. Position Build Up- Call Option. Digital world acquisition corp com.

Position UnWinding- Call Option. Here is the list of Most Active Securities or Most Active Shares Stocks. Liquid stocks on the NSE consist of stocks that have traded in high volumes or high values on a given day.

High Implied Volatility Call Options 24112022. High Implied Volatility Call Options 29122022. FO - Listing of Stock With High Call Options Implied Volatility for Indian Stocks near month expiry date 27102022.

NSE now offers NVIX ie. YOU ARE ON THE. Run queries on 10 years of financial data.

FO - Listing of Stock With High Put Options Implied Volatility for Indian Stocks near month expiry date 27102022. PEL 2200 historical IV PEL. Highest Implied Volatility Options.

IV Rank is the at-the-money ATM average implied volatility relative. Latest Sma volume60 Greater than equal to Number 1000000. PEL option chain PEL 2100 historical IV.

T echnicals S tability R eturns. Stocks Features Premarket Trading. Globally exchanges are offering derivative products based on the.

Low PCR Open Interest. Get a complete list of stocks that have touched their 52 week highs during the day on NSE.

/stock-market-836258860-d77c2ae20cf849a491583ed4008547e4.jpg)

Implied Volatility Iv Definition

Iv Rank Vs Iv Percentile Which Should You Use

How To Research Volatile Stocks

Fortune India Business News Strategy Finance And Corporate Insight

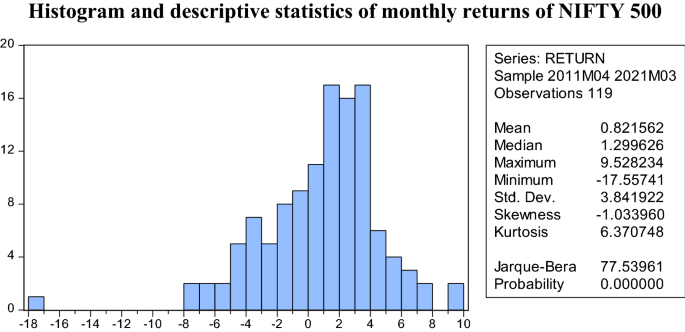

Pdf Historical And Implied Volatility An Investigation Into Nse Nifty Futures And Options

Month Of The Year Effect Empirical Evidence From Indian Stock Market Springerlink

Specialty Chemical Stock Turns 1 Lakh To 1 27 Cr In 15 Years Buy Mint

Is Honeywell Automation India Limited S Nse Honaut High P E Ratio A Problem For Investors

Find Out When Implied Volatility Is High Or Low To Trade Options Profitably

What Is Implied Volatility Option Value Calculator

Best Stocks To Buy In India For Long Term 2022 Getmoneyrich

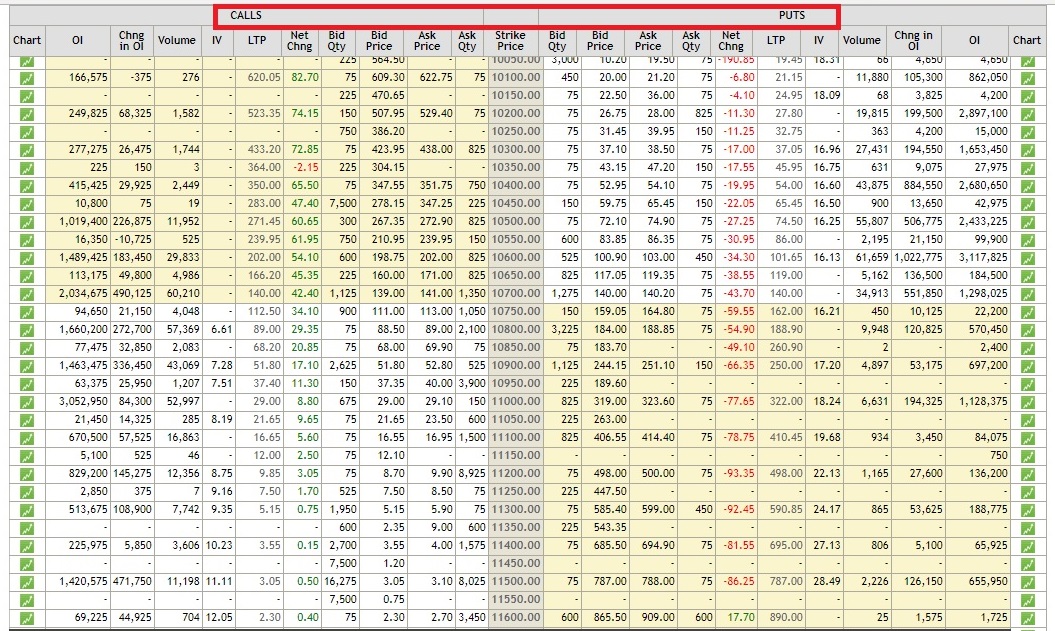

School Of Stocks Reading Option Chain Using Volume Oi

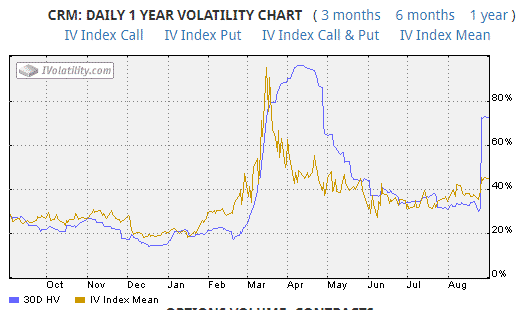

Where Can I Find An Iv Chart Implied Volatility For Free Quora

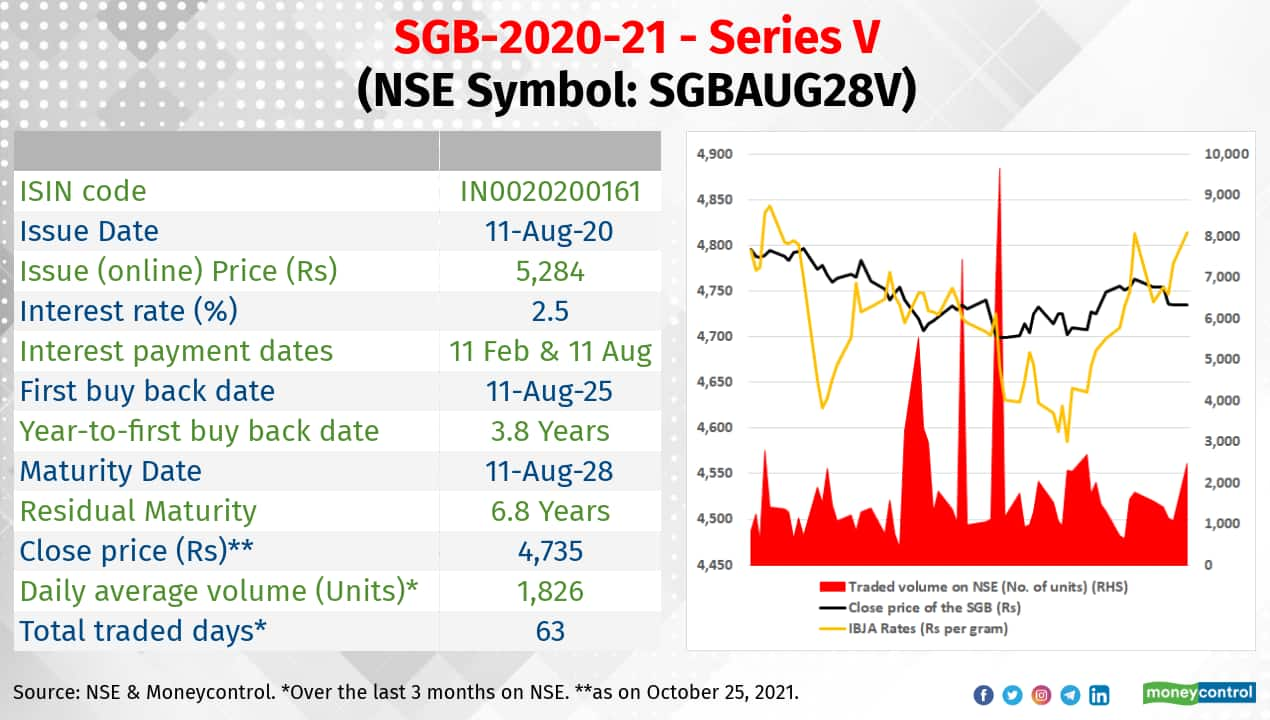

Want To Buy Sovereign Gold Bonds You Can Choose Between The Fresh Issue And These Six Series Traded On The Nse

How To Read Options Chain Explained With Example

Stock Options Chain Analysis Using Excel Analytics Vidhya

Implied Volatility What Why How

Iv Percentile Vs Iv Rank Ivp Vs Ivr In Options Trading Stockmaniacs